Our Strategy

At Evergreen Holdings, our strategy is built on leveraging decades of expertise to identify, acquire, and optimize real estate assets that maximize value for our stakeholders. Our approach focuses on precision, innovation, and unparalleled execution in every acquisition and management decision.

Core Strategic Pillars

AUCTION EXPERTISE

We dominate the auction space, having successfully acquired over 1,000 properties nationwide. Our deep understanding of the auction process allows us to act swiftly and strategically, securing high-value opportunities others overlook.

DISTRESSED ASSET SPECIALIZATION

Our proficiency in acquiring and managing distressed assets, including REOs, tax deeds, and tax certificates, enables us to turn challenges into profitable investments. We thrive where others see obstacles.

MARKET-DRIVEN APPROACH

Leveraging cutting-edge market analytics and trend forecasting, we identify undervalued assets and position ourselves ahead of market shifts, ensuring consistently high returns.

DIVERSE PORTFOLIO DEVELOPMENT

By focusing on commercial and residential real estate, we build balanced portfolios that mitigate risk and maximize growth potential.

ASSET OPTIMIZATION

Beyond acquisition, we transform assets into high-performing investments through innovative strategies and meticulous management, unlocking untapped value.

Advantages to Auction Sales

Full transparency

- Asset status

- Lease agreements

- Payments

- Occupancy

Assets are free and clear of all debt and any encumbrances

Properties typically enter auction due to loan maturity, rather than bankruptcy or poor management

Disadvantages to Auction Sales

Instant capital is required

Once an auction is won, the winner must put 10% of the required capital down within 24 hours, and the remaining balance must be paid within the first 30 days.

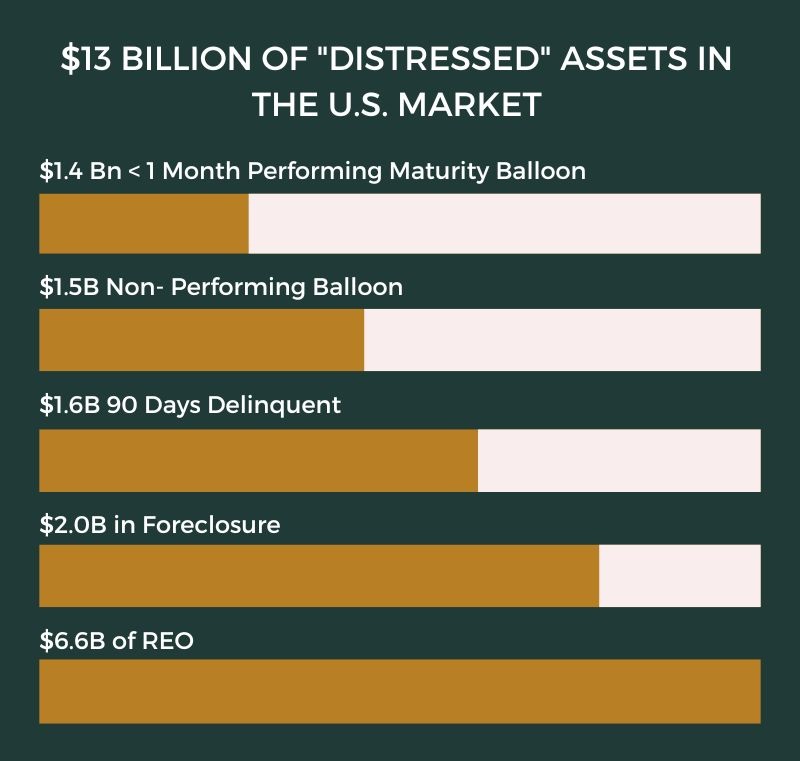

Market Opportunity

A substantial volume of distressed CMBS assets are currently facing maturity and default challenges.

– BRIGHTON CAPITAL ADVISORS

– TREPP

Fitch Ratings projects that overall U.S. CMBS loan delinquencies will double from 2.25% in November 2023 to 4.5% in 2024 and 4.9% in 2025, with the office sector expected to experience the greatest decline in property net cash flows.

– FITCH RATINGS

REO Sellers We Work With

…and more

Reference and Banking Lenders

Our network of banking lenders includes banks and brokers and spans across multiple states in the U.S., including New York, Florida, Kansas, Minnesota, and North Carolina, among others. We’ve worked with institutions like 1st National Bank, TD Bank, 1st United Bank, and many other financial entities.

“Our interaction with Mr. Gratsiani and his team has been a pleasure. In our opinion, your company is of good financial standing and of high business integrity.”

Deborah A. Romero, President & CEO

“This letter is to certify that our customer Gideon Gratsiani, closed an investment commercial real estate mortgage with the Bank.”

Daniel Gallagher, Relationship Manager

“Mr. Gratsiani, We appreciate your effort and expertise in bringing this transaction to a successful conclusion. We look forward to working with you in the future.”

Dan Skeesley, REO Asset Manager

“Mr. Gratsiani, We value our relationship with you and your staff. I look forward to negotiating future transactions with you on either Notes or Properties that meet your criteria.”

Catherine J. Bonner, Vice President

“Mr. Gratsiani and his team have been a pleasure. In our opinion, Evergreen Holdings is of good financial standing and of high business integrity.”

Jennifer Perkins, Commercial Relation

“Mr. Gideon Gratsiani , Throughout the underwriting and closing process, I valued your team’s professionalism, expertise, and support.”

Nick Hodel, Business Banker

“Dear Mr Gratsiani, We value our relationship and look forward to working with you in the future.”

Raquel Ramirez, Special Assets Dept.

“Mr Gratsiani, We value our relationship and look forward to working with you in the future.“

Michael Rinaldi, Vice President

“Mr. Gideon Gratsiani, Should you wish to purchase another property from SunTrust, please let me know.”

Christyne Albury, First Vice President

“Mr. Gideon Gratsiani, The level of trustworthiness you established with the Bank was the key to a successful transaction.”

Peyton LaCaria, Vice President

“Mr Gratsiani , It was a pleasure dealing with you and your staff in bringing this purchase together.“

Chase Young, Vice President

“It truly was a pleasure working with you. You are pros. Our team was very impressed with how impressive you are.”

Christopher Kinnard, Investment Sales

“Mr. Gideon Gratsiani, Waller Group is looking forward to working with you in the future.”

Logan Waller, Owner

“Dear Mr. Gratsiani, congratulations. This deal was a very rare opportunity, and you did a fantastic job sourcing and executing on this transaction. The team was a pleasure to work with.”

Daniel Kaweblum, Senior Vice President

“Mr. Gratsiani and his team stood by their word and met their terms and agreements without difficulty.”

Steven Koutsantonis , President

“Dear Mr. Gratsiani, We appreciate your effort and diligence in leading this transaction to a successful conclusion.”

Jeffrey Wolfer, President & CEO

“Mr. Gratsiani, We appreciate your effort and diligence in bringing this transaction to a successful conclusion.”

David Hoppe, Investment Advisor

“Dear Mr. Gratsiani, It was a pleasure working with you and your staff.”

Hiren Naik, Vice President

“Mr Gratsiani, As with many complex real estate transactions, teamwork between the Borrower and the financial institution is crucial to a successful closing.“

Michael Duval, Vice President

“Mr. Gideon Gratsiani, It was a real pleasure working with your firm. The level of professionalism shown by your firm were key to closing this transaction.”

Dean Kaplowitz, Vice-President

“Mr. Gratsiani, We truly appreciate your effort and diligence in leading this transaction to a successful conclusion. Our team looks forward to working with you in the future.”

Heidi Adams, Senior Advisor

“Dear Gideon, Even though you weren’t the highest offer, we opted to transact with you given the surety of close.”

Rick Drogosz, Principal

“Mr. Gideon Gratsiani, You and your team were a pleasure to work with. I hope we can work together soon on another acquisition.“

Ronald D. Allum, Managing Principal

“Mr. Gideon Gratsiani, It was a pleasure dealing with you and your staff in bringing this purchase together.”

Evan Lyons, Senior Adviser

“Mr. Gideon Gratsiani, Your team was excellent to work with and it is a real pleasure to find a company like yours that delivers what they say.“

Reese Stigliano, S. Vice President

“Mr. Gideon Gratsiani, I’ve closed hundreds of commercial real estate loans and the people you have working your deals we’re very organized, professional, and easy to deal with.

Brian Anderson, Managing Director

“Dear Mr. Gratsiani, It was a pleasure working with you and your group on this loan opportunity. We could not have asked for a smoother closing.”

Marissa Wilbur, Vice President